Energy regulator announces renewables auction results

On 25 June 2021, the president of Poland’s Energy Regulatory Office announced the results of the May/June 2021 auctions for sale of renewable energy. Unlike in previous years, the results of all auctions announced in 2021 were released on one day.

Continued dominance of photovoltaics and onshore wind, unused pool of funds

In line with a trend observed for years, the entire planned volume of electricity (69.5 TWh) was not purchased. Only 36.8 TWh, worth PLN 8.5 billion, was contracted for purchase (the government limit was PLN 24.6 billion). This is a much smaller volume than in 2020, when 54.5 TWh of electricity was contracted for almost PLN 12.9 billion.

This shows a significant decrease in bid prices, but also reveals the potential awaiting investors on the Polish market.

Equalisation of prices in this year’s auctions for large onshore and solar installations

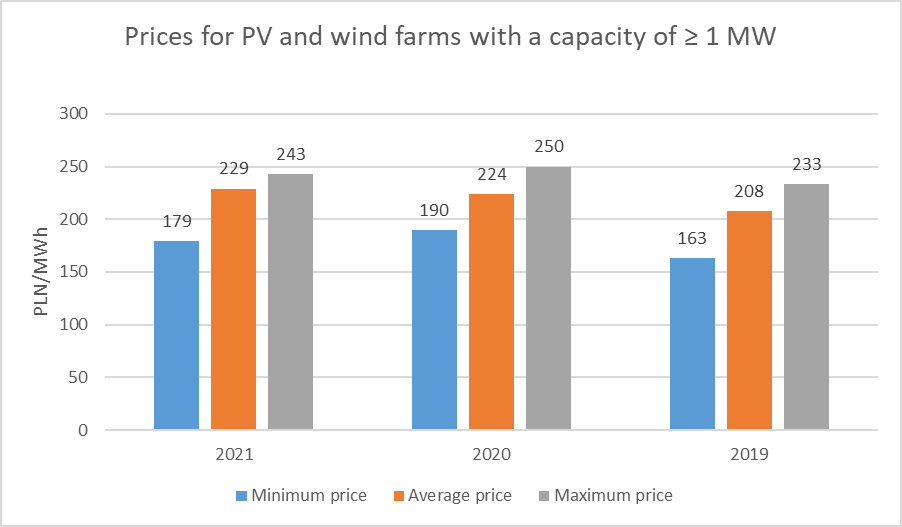

As in previous years, the largest volume of energy was contracted during auctions for photovoltaic installations and wind farms with a capacity above 1 MW (24.7 TWh for PLN 5.7 billion). Although both the minimum and maximum bid prices were lower than last year, the average price per MWh increased from PLN 224 to 229.

Minimum, maximum and average contracted energy prices at the auction for wind and PV farms with a capacity of 1 MW or more in 2019–2021 are illustrated in the graph below.

The maximum selling price of electricity was PLN 242.98/MWh and the minimum price was PLN 179/MWh. This year’s reference prices (i.e. the highest possible prices foreseen in the bids) did not change from last year for onshore wind farms with an installed capacity of 1 MW or more, at PLN 250/MWh. However, for photovoltaic installations with an installed capacity of 1 MW or more, the reference price was reduced from PLN 340 to 320/MWh.

It is estimated that 1,500 MW of new capacity will be created through this auction: 1,200 MW in photovoltaic installations and 300 MW in wind farms.

Further reduction of bid prices in auctions for PV installations and wind farms with capacity below 1 MW

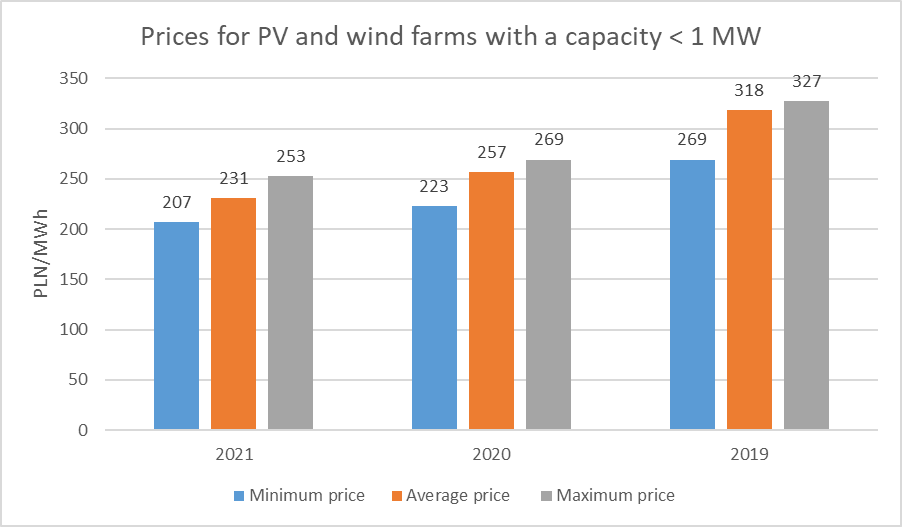

In this year’s auction for PV installations and wind farms with a capacity below 1 MW, more energy was contracted (11.95 TWh) than last year (11.74 TWh). Nevertheless, the total cost decreased from PLN 3.0 billion to 2.76 billion.

Unlike in the case of auctions for installations with a capacity of 1 MW or more, a steady downward trend in prices is observable for the basket of smaller installations. This applies to average, minimum and maximum prices. This shows that the costs of these technologies are steadily decreasing without any major turbulence.

Minimum, maximum and average contracted electricity prices at the auction for wind and PV farms with a capacity lower than 1 MW in 2019–2021 are illustrated in the graph below.

This year’s reference prices (i.e. the highest possible prices foreseen in the bids) for photovoltaic installations with a capacity below 1 MW, similar to last year, were reduced by PLN 20, from PLN 360 to 340/MWh. The reference prices for small wind power plants, with a capacity below 1 MW, remained at the same level as in 2019 and 2020 (PLN 320/MWh).

It is estimated that about 1,000 MW of new capacity in photovoltaic installations will be created through this auction.

No takers in auctions for alternative technologies despite increase in reference prices

Apart from the auctions for wind and photovoltaic farms, only the auction directed at small hydroelectric power plants selected a winning bid. Among other reasons, the participation of generators in this auction resulted from the increase in this year’s reference prices for this technology, from PLN 620 to 640/MWh for hydroelectric power plants with a capacity less than 500 kW. Only five bids were submitted in this auction, slightly above the minimum number of bids necessary to select a winning bid. Due to the small number of participants, there was not a large spread of prices in the bids, as the lowest price was PLN 637.07/MWh and the highest was PLN 639.15/MWh.

The increase in reference prices compared to last year also applied to other technologies, such as landfill biogas in cogeneration (increased by PLN 45/MWh) and hydroelectric power plants larger than 500 kW (increased by PLN 15/MWh). However, this increase was not sufficient to motivate generators to participate in this year’s auctions.

Upcoming amendment of the Distance Act and its impact on the renewables market in Poland

The increase in average auction prices for installations with a capacity of 1 MW or more is mainly caused by the limited availability of land for design and construction of new wind farms, as well as the ban on amending construction permits for projects to allow for technological developments in the industry. These restrictions result from severe limitations on the possibility of siting these power plants. Their distance from residential buildings cannot be less than 10 times the total height of the turbines together with the blades.

Introduced in the “Distance Act” in 2016, this rule halted the design process for new wind farms. However, work has been underway since 2020 to liberalise this rule. In May, the first draft of a bill was published under which new wind farms could be built at a distance of no less than 500 metres from residential buildings, provided that an appropriate local zoning plan is adopted for the area.

However, even with rapid and far-reaching liberalisation of the Distance Act, due to the required administrative procedures, it will be a few years before new projects appear in large numbers.

Igor Hanas, adwokat, Rafał Pytko, Energy practice, Wardyński & Partners