Proposed changes would increase tax burdens on top earners

One of the flagship elements of the political programme called the “Polish Deal” is changes in personal income tax and social insurance contributions. This will lead to a drastic increase in the burden on top earners, especially business operators.

The mechanism proposed by the Ministry of Finance is supposed to limit the negative effects of the increasing tax burden on the lowest earners. However, the definition of the middle class adopted by the Ministry of Finance, and the exclusion of business operators from this group, arouses great emotions. The complicated mechanism of the relief, or rather the formula for calculating it, is becoming a symbol of the “Polish Deal” (Polski Ład), a project promoted under the slogan of simplification of the tax system.

A new basis for health insurance contributions

The proposal would implement the heralded unification of the basis for calculating health insurance contributions and elimination of the ability to deduct these contributions from income tax.

The change would primarily affect business operators, who would lose the ability to pay a lump-sum health insurance contribution based on the average wage (in 2021, the lump-sum contribution is PLN 381.81 per month). According to the draft, as of 1 January 2022 the health insurance contribution will be calculated based on the taxpayer’s actual income, and will amount to 9% of the assessment base, but with the contribution not being lower than that calculated based on the minimum wage. No annual upper limit on contributions, such as for pension and disability insurance, is foreseen. The change would apply regardless of the form of taxation (tax scale or flat rate).

Persons paying income tax at a flat rate on recorded revenue will pay a monthly contribution based on their income. In this case, the contribution will be calculated at one-third of the flat rate on recorded revenue applied to the taxation of this income.

The health insurance for shareholders in single-person limited-liability companies or partners in limited partnerships will continue to be based on a lump-sum contribution, although the basis for calculating it would increase to the average wage (currently it is 75% of the average wage).

No possibility to deduct a part of the health insurance contribution from income tax

The second significant change is the lack of the possibility to deduct health insurance contributions from income tax. Currently, a significant portion of the contribution (7.75% of the assessment base) is subject to such a deduction. As a result, its ultimate economic burden is largely imperceptible. The proposed change would dramatically increase the effective burden not only on business operators but also on employees.

A new feature is that management board members would be covered by health insurance contributions. Until now, management board members have paid contributions in a situation where their board appointment was combined with another contract providing entitlement to health insurance (e.g. an employment contract or managerial contract). According to the government’s proposal, the compensation of management board members will be subject to contributions also in a situation where the member’s appointment results exclusively from a resolution appointing the person to the board.

Whose effective burden will increase?

For workers with an income below the national average, the additional burden resulting from not being able to deduct a part of the health insurance contribution from income tax would be offset to some extent by the increased tax-free amount.

Pursuant to the government’s proposal, the amount excluded from personal income tax will increase to PLN 30,000. Unlike the current solution, the tax-free amount would not be degressive in nature, so it would not decrease as income increases.

The tax-free amount would remain available only to those who settle income tax based on the tax scale.

The increase of the second threshold of the tax scale to PLN 120,000 would not benefit taxpayers, but only neutralise the unfavourable changes for them resulting from the inability to deduct part of the health insurance contribution from their income tax.

Relief for the middle class

The proposal introduces a mechanism for middle-class relief, i.e. for people earning between PLN 68,412 and PLN 133,692 gross per year.

This institution is relief in name only; in fact, it is responsible for ensuring that the fiscal burden on a strictly defined group of taxpayers does not increase.

This amount does not include income from the transfer of copyright, to which the higher deductible costs of 50% apply.

The relief would only apply to employees and would be calculated based on the following formulas:

- For the range from PLN 68,412 to PLN 102,588

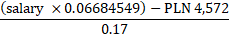

- For the range of greater than PLN 102,588 to PLN 133,692

The amount resulting from the above calculations would be deductible from income.

For a person earning 150% of the national average (i.e. PLN 103,954 gross per annum) the annual relief would amount to PLN 13,982, which translates into a tax reduction of PLN 2,377. However, if an employee fell within the second relief bracket (for example, 170% of the national average, i.e. PLN 117,815), the annual relief would be lower, at PLN 6,864, reducing the tax by PLN 1,167.

If the gross amount of PLN 133,692 were exceeded even by one zloty, the employee would not be entitled to apply the relief to the amount falling within the “middle class” bracket. This would mean an effective increase in public charges paid by such a person compared to the current state.

Jakub Macek, attorney-at-law, tax adviser, Tax practice, Wardyński i Wspólnicy