On-site generation of industrial electricity and heat: What should plants know before investing in their own energy sources?

The rising costs of electricity and CO2 emission allowances are prompting an increasing number of businesses to consider investing in their own generation sources, including renewable energy sources. However, such an investment involves not only the purchase of appropriate equipment and finding a contractor. It also requires meeting a number of regulatory obligations and ensuring that the operations of the source are supported after it is placed in service.

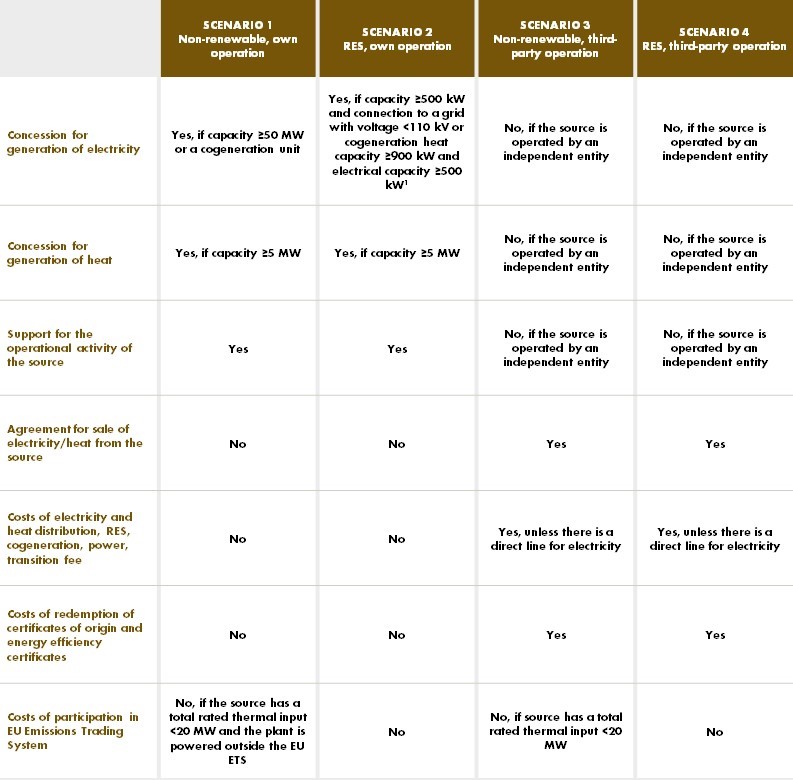

In our 2021 Yearbook, we reviewed the solutions for self-generation of electricity existing on the Polish market. Here we will discuss the regulatory obligations for the four most common scenarios, differing in the type of source (renewable or non-renewable) and the identity of the operator of the installation (the business itself or another entity).

Business’s obligations

Scenario 1: Non-renewable source on or adjacent to the business’s plant operated by the business itself

In this scenario, fulfilment of all regulatory obligations stipulated in the Energy Law will lie with the business, as legal title and actual operation of the source rest with the business. Therefore, in certain situations, it will be necessary to obtain a concession for electricity/heat production and to fulfil related obligations to report to the president of Poland’s Energy Regulatory Office (URE).

The process of obtaining the concession itself and the subsequent fulfilment of regulatory obligations can be burdensome, and breach of these obligations may result in high fines. Therefore, obtaining a concession and fulfilling regulatory obligations can be outsourced to an installation operator. It is highly likely in the case of most businesses that they will not be competent to conduct operation of the installation on their own, but will need to contract for services under an operation and maintenance contract or similar contract.

In terms of costs, an undoubted benefit of this scenario is the lack of need to enter into a contract to sell and distribute electricity/heat to the plant, as both the plant and the source belong to the same entity (self-generation). This means no distribution fees, no surcharges on electricity prices (RES, cogeneration, capacity or transition fees) and no need to allow for the costs of redemption of certificates of origin under the Renewable Energy Sources Act or energy efficiency certificates under the Energy Efficiency Act.

Whether Scenario 1 will require the inclusion of emissions of this source in the EU Emissions Trading System will depend on three factors:

- Total rated thermal input (sources below 20 MW remain outside the EU ETS)2

- Source type (hazardous and municipal waste incineration plants remain outside the EU ETS)

- Whether the plant fed by the source is eligible for the EU ETS. If so, the emissions from the new source will have to be included in the EU ETS regardless of the capacity power of the source (even below 20 MW). This is because the same entity is the actual user of both the plant and the source that supplies it.

Scenario 2: RES on or adjacent to the business’s plant operated by the business itself

This scenario differs from the previous one in the type of source built, i.e. construction of a renewable energy source. Generally, the above remarks also apply here, with one important difference: in principle, RES do not emit CO2, so they remain outside the EU ETS. Such a source is free of potential costs associated with having to include emissions in the EU ETS.

Scenario 3: Non-renewable source operated by another entity

In this scenario, the legal title and actual operation of the source rest with an entity other than the business itself (e.g. a subsidiary of the business, or a partner with whom the business carries out the development of the new source, specialised in implementation and subsequent operation of such projects). Therefore, obtaining the necessary concessions, entries and permits as well as fulfilment of the obligations under the concession and contained in the Energy Law will rest on the entity actually operating the source, and not on the business itself, provided that the operator is an independent entity. It will be similar with the need to provide support for ongoing operation of the source.

However, this scenario does not involve self-generation, and thus it will be necessary to enter into the relevant contracts to ensure the supply of energy and heat to the business. This will make it necessary to pay distribution fees and surcharges on the price of electricity (RES, cogeneration, capacity, transition fee), unless a decision can be obtained from the president of the Energy Regulatory Office allowing the source and the plant to be connected with a direct line for electricity supply (which happens very rarely, however).

In addition, the price of energy sold should reflect the cost of redemption of certificates of origin under the Renewable Energy Sources Act and energy efficiency certificates under the Energy Efficiency Act.

In Scenario 3, when qualifying the source for the EU ETS, it does not matter whether the supplied plant is already in the system or not, as the source is operated by an entity other than the plant. This means that the only criterion for source qualification (assuming that the entity operating it does not already operate other sources) will be its total rated thermal input (sources below 20 MW are outside the EU ETS).3 Sources that are incinerators of hazardous or municipal waste will also remain outside the EU ETS.

Scenario 4: RES operated by another entity

Scenario 4 differs from the previous one because it involves implementation of a source that qualifies as a renewable energy source. Here again, the only difference from Scenario 3—but a significant one—is the lack of costs related to possible qualification of a source for the EU ETS, which would have to be included in the price of electricity and heat sold to the business.

Tax issues (including excise duty) remain beyond the scope of this article, but it is worth mentioning that the implementation of scenario 3 or 4 will involve the necessity to charge excise duty on the electricity sold to the business.

The use of assets belonging to other entities is common and for many years has been one of the basic elements of conducting any business, for many different reasons. Leasing of car fleets or warehouse space has become a permanent fixture of operation of businesses. Similar tools in the field of electricity generation can be applied to achieve additional savings.

Marek Dolatowski, adwokat, Rafał Pytko, Energy practice, Wardyński & Partners

1 Below the indicated values, necessary obligations to fulfil for micro- or small installations, respectively (depending on power and type of source). The threshold for the concession obligation will probably soon be raised to 1 MW.

2 Taking into account the rules for aggregating the capacity of individual equipment within an installation, which allow exclusion of, among others, the capacity of installations below 3 MW or installations using only biomass and waste incineration facilities. A discussion of the detailed rules of eligibility of installations for the EU ETS is beyond the scope of this article.

3 As in note 2.