Guide to the Foreign Subsidies Regulation: Key facts for businesses, part 1

More and more companies from outside the EU are operating on the internal market—investing, acquiring local companies, winning public tenders. Until recently, they could operate with the advantage of support from their home countries. But now, under the Foreign Subsidies Regulation, the European Commission can examine their situation to ensure fair competition on the internal market.

In this guide we explain what the FSR is, who is affected by it, what new obligations it introduces, and when it is necessary to notify financial support received from outside the EU. We have compiled practical examples and tips on how to prepare for the new requirements.

What is the FSR, and how does it work?

The FSR—Regulation (EU) 2022/2560 of the European Parliament and of the Council of 14 December 2022 on foreign subsidies distorting the internal market—has applied since 12 July 2023 to all undertakings operating on the EU internal market (whether they are registered in the EU or elsewhere).

The FSR is designed to ensure fair competition and equal conditions for undertakings operating on the internal market, and to ensure the competitiveness of the European market.

The regulation requires certain forms of financial support to be notified to the European Commission—particularly in the case of mergers and acquisitions and in large public tenders.

Why do we need the FSR?

More and more companies from non-EU countries are investing, acquiring other companies, or entering tenders on the EU market. Before, such companies might enjoy a financial advantage thanks to support from their governments or other institutions, which sometimes distorted competition.

The FSR introduces clear rules so that all companies have an equal chance, regardless of the country of origin of their capital.

Example:

A company from outside the EU receives a subsidy from its home government, allowing it to offer a lower price in a public tender in Poland. The FSR is intended to make such situations transparent and fair for all market participants.

When does financial support have to be notified under the FSR?

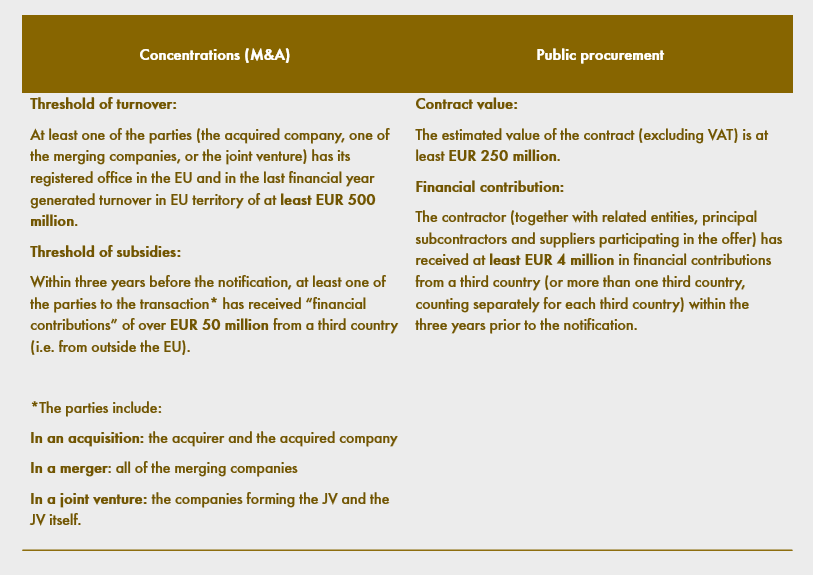

The FSR requires notification of financial support in two key instances: participation in concentrations, and participation in public procurement.

The table below outlines the conditions that must all be met for notification to be mandatory.

Examples:

- Acquisition. An American company wants to buy a company from France. The French company had turnover in the EU in the previous year of EUR 700 million, and in the last three years the two companies together received a total of EUR 60 million in support from the US government (including grants, preferential loans, and guarantees). The transaction must be notified to the Commission.

- Tender. A Korean company is entering a tender for construction of infrastructure in Germany (contract value EUR 300 million). In the past three years the company and its principal subcontractor received a total of EUR 5 million in support from the Korean government. The bid must be notified to the Commission.

Ex officio review

Apart from mandatory notification by companies, the European Commission has the right to commence proceedings at its own initiative (ex officio). This means that even if the company does not report financial contributions from a third country (for example because the company did not reach the notification threshold or was not aware of the support), the Commission can launch an investigation if it suspects that the support may distort competition on the EU market.

How can the Commission learn of potential subsidies from a third country?

- The information may come from various sources: media, competitors, national authorities, whistleblowers, or the Commission’s own analysis of the market.

- The Commission does not need to rely on official reports—it can act on circumstantial evidence or even industry rumours.

What situations are particularly vulnerable to ex officio investigation?

- Transactions and tenders of high value, particularly involving strategic sectors (such as energy or infrastructure)

- Support in atypical forms, such as debt forgiveness, unlimited guarantees, or investments by sovereign funds.

The concept of “financial contribution”—key to understanding the FSR

To determine whether an entity has a notification obligation under the FSR, it must be determined whether the entity has received a foreign subsidiary, i.e. a “financial contribution.”

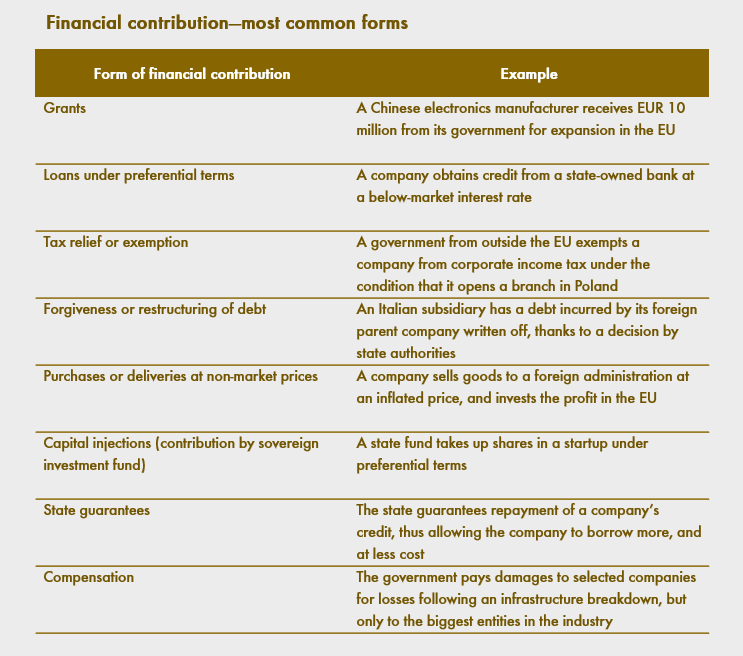

For purposes of the FSR, a financial contribution is any support which:

- Gives an advantage to an undertaking which is not available under normal market conditions

- Confers a benefit

- Is selective, i.e. is limited legally or factually to a selected undertaking or industry, and

- Is made directly or indirectly by a third country (it may come from the state or from a private entity acting on behalf of the state).

Note! If a company would not be in a position to obtain such financial support from private investors or on the market, then it is almost certainly a “financial contribution” for FSR purposes.

Financial contribution distorting the internal market

Financial contributions by third countries to companies operating in the EU will not always distort competition on the internal market. Under the FSR, a foreign subsidy is deemed to distort competition on the internal market when the foreign subsidy is liable to improve the competitive position of an undertaking in the internal market, so that the foreign subsidy actually or potentially negatively affects competition in the internal market.

The Commission examines financial contributions with a view to:

- Factors involving the foreign subsidy (amount, nature, purpose, conditions, how the subsidy is used in the internal market), and

- The situation of the undertaking (its size, the sector, and the evolution of the undertaking’s activity on the internal market).

According to the FSR there is a high risk of distorting competition on the internal market in the case of a foreign subsidy which:

- Is granted to an undertaking which would likely go out of business in the short or medium term in the absence of any subsidy

- Is granted in the form of a guarantee without limitation in amount or duration

- Constitutes an export financing measure not in line with the OECD Arrangement on Officially Supported Export Credits

- Directly facilitates a concentration, or

- Enables an undertaking to submit an unduly advantageous tender for award of a public contract.

In such instances, the Commission will require additional detailed information so that it can assess whether the subsidy will actually distort competition on the internal market. The undertaking can also present a justification showing that under the specific circumstances, the subsidy will not have a negative impact on the internal market.

Why is this so important?

Failure to notify a financial contribution can lead to imposition of high penalties (fines of up to 10% of the undertaking’s global turnover in the preceding year). The Commission can also bar the undertaking from participating in public tenders.

The notification obligation doesn’t apply only to huge corporations. Even smaller companies may fall under the FSR if they receive foreign support.

What should companies do now?

To avoid the consequences of infringing the Foreign Subsidies Regulation, undertakings should:

- Examine whether the company or affiliates have received any support in recent years from countries outside the EU

- Gather documents concerning grants, loans, tax incentives, guarantees and other forms of support

- Prepare to notify such contributions to the Commission.

In subsequent sections of our guide, we will discuss in more detail the notification procedure, the most important formal obligations, and how to effectively prepare for an inspection by the European Commission.

Dr Anna Kulińska, Serom Kim, adwokat, State Aid & EU Internal Market practice, Wardyński & Partners