Draft Recommendations on insurance distribution and their impact on foreign insurers

Will the proposed Recommendations of the Polish Financial Supervision Authority on insurance distribution affect the activity of foreign insurers operating in Poland through a branch or under the EU’s freedom to provide services and passporting scheme?

On 24 February 2025 the Polish Financial Supervision Authority (KNF) published on its website the draft Recommendations for Insurance Institutions on Insurance Distribution and announced that it was beginning consultations on the proposal. The Recommendations are aimed at unifying insurers’ application of the regulations, and ensuring legal protection of customers on the insurance market more broadly.

The proposal includes 43 recommendations divided into 12 areas. Consultations on the proposal will run until 26 May 2025.

Insurance institutions operating in Poland through the freedom to provide services (based on a “European Passport”) will be covered by the core provisions of the Recommendations, excluding chapters I and XII (concerning insurers’ management boards and supervisory boards, internal control systems, compliance function and internal audit function).

The Recommendations would supersede the KNF Guidelines on Insurance Distribution, which have been in effect since 31 March 2015.

How does the current draft of the Recommendations differ from the existing Guidelines?

The existing Guidelines cover only four areas: management board and supervisory board, insurance distribution models, customer relations, and internal control systems.

The draft Recommendations released by KNF cover the following thematic areas (related to insurance distribution):

- Duties of an insurance institution’s management board and supervisory board

- Organisation of an insurance institution’s distribution activities

- Remuneration system for employees conducting an insurance institution’s distribution activities

- Value of distributed insurance products for customers

- Analysis of customers’ needs and requirements, and performance of other obligations to customers by an insurance institution

- Insurance institution’s cooperation with agents

- Insurance institution’s cooperation with brokers

- Insurance institution’s cooperation with undertakings referred to in Art. 2 of the Insurance Distribution Act

- Organisational solutions in the process of an insurance institution’s oversight and management of products with respect to insurance distribution

- Insurance contracts concluded for another’s account

- Management of conflicts of interest

- The role of the internal control system, the compliance function, and internal audit in insurance distribution.

These chapters set forth a total of 43 detailed recommendations.

Significantly, the current wording of the Insurance and Reinsurance Act does not provide for the possibility of the regulator issuing “guidelines” as an instrument with a construction similar to recommendations. The existing Guidelines were issued under the previous regulatory act (Insurance Act of 22 May 2003).

Nonetheless, some public-law commentators take the view that guidelines are an oversight measure which KNF issues not under the authorisation of the Insurance and Reinsurance Act, but under the Financial Market Supervision Act of 21 July 2006. In this view, issuance of guidelines would implement the regulator’s task (under Art. 2 and Art. 4(1)(2) of that act) to ensure proper functioning of the financial market (including the insurance market).

Regardless, instructions from the regulator in the form of recommendations, strictly governed by Art. 365(1)–(5) of the Insurance and Reinsurance Act, exert a huge impact on the legal situation of insurance companies, particularly Polish ones subject to the strict supervision of the Polish Financial Supervision Authority. These recommendations fall under the rule of “comply or explain.” This means that a Polish insurer which does comply with issued recommendations, and does not intend to comply, must inform KNF accordingly, while explaining what method it will use to achieve the aims for which KNF issued the recommendation.

Obviously, this rule does not apply to foreign insurers operating in exercise of the EU’s freedom to provide services via the passporting scheme. Under Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II), specifically Art. 30 of the directive (implemented in Art. 204(3) of the Insurance and Reinsurance Act), such insurers are subject to the exclusive financial supervision of their home regulator (even if they provide services in Poland).

But when it comes to non-financial supervision, it is recognised in the public-law literature that general oversight is vested in the regulator for the home jurisdiction (registered office) of an insurance institution, while auxiliary oversight, limited to universally binding law, is vested in the regulator for the host jurisdiction (P. Wajda in M. Szczepańska (ed.), Insurance and Reinsurance Act: Commentary (Warsaw 2017), Art. 204)—as stated for example in Art. 30(3) and 34 of Solvency II. It is correctly pointed out that the competence of the regulator cannot be presumed, and “soft law” (such as guidance) cannot be regarded as universally binding law.

This raises the question whether KNF’s draft Recommendations will also apply to foreign insurance companies—operating in the form of a branch or in exercise of the freedom to provide services and passporting—and if so, in which respects.

To answer this question, we should compare the existing Guidelines with the draft Recommendations now being considered, in light of the Insurance and Reinsurance Act.

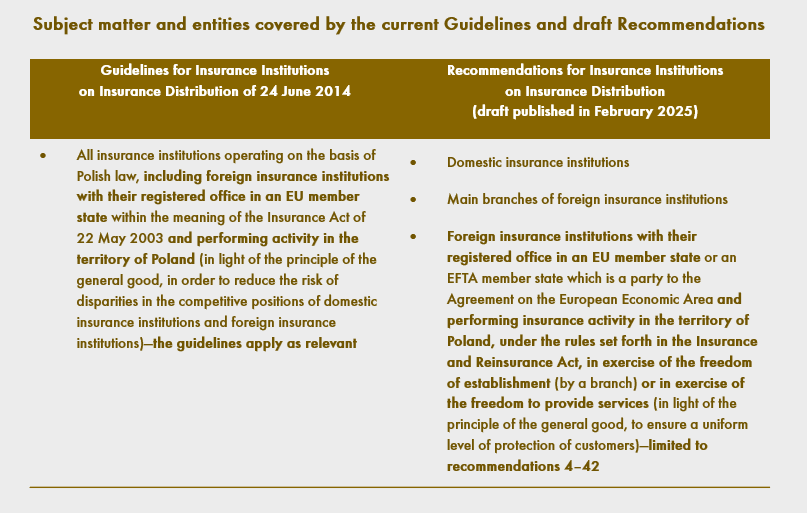

Who is targeted by the draft Recommendations, and who was targeted by the existing Guidelines?

Thus the existing Guidelines, whose subject matter is relatively narrow compared to the proposed Recommendations, do cover the activity of foreign insurance institutions, but only “as relevant” (w odpowiednim zakresie). This term is vague enough—alluding indirectly to the principle of proportionality—that it has allowed for great discretion in interpretation, particularly in the context of foreign insurers’ planning to expand into the Polish insurance market.

By contrast, the current draft Recommendations expressly state that foreign insurance institutions must comply with recommendations 4–42 (i.e. excluding the chapters on the management board and supervisory and on internal controls—which is natural in light of the EU’s Solvency II Directive).

It should be explained in this respect that under Art. 365(1) of the Insurance and Reinsurance Act, “The supervisory authority may issue recommendations directed to insurance institutions and reinsurance institutions.” Interestingly, the Insurance and Reinsurance Act does not contain a definition of the notion of an “insurance institution” (zakład ubezpieczeń) as such. However, the list of legal definitions in the act does contain definitions of “domestic insurance institution” (Art. 3(1)(18)) and “foreign insurance institution” (Art. 3(1)(55)).

A linguistic, functional and systemic interpretation points to the conclusion that the undefined term “insurance institution” includes both “foreign insurance institutions” and “domestic insurance institutions.” But it should be borne in mind that the Insurance and Reinsurance Act is a regulatory act, and therefore should always be interpreted narrowly. This is particularly justified in light of Art. 8 of the Business Law of 6 March 2018, which (carrying forward the “Wilczek principle” adopted near the end of the communist era) states: “A business may take up any activities other than those prohibited by law. A business may be obliged to act in a certain way only on the basis of regulations of law.” (This obviously applies to Polish businesses, but nonetheless it is applied universally, with certain exceptions, see Business Law Art. 9 and 11.)

This principle may also apply to foreign businesses, as under Art. 4(1) of the Act on the Rules for Participation of Foreign Undertakings and Other Foreign Persons in Commerce in the Territory of Poland of 6 March 2018, “Foreign persons from member states may take up and perform economic activity in the territory of the Republic of Poland under the same rules as Polish citizens.”

This interpretation is particularly justified in light of Solvency II and the principle that foreign insurance institutions should be subject to oversight mainly by their home regulators (and exclusive oversight in financial matters). For this reason as well, if the Polish regulator finds any infringements, besides issuing the relevant summons it will also notify the institution’s home regulator, which—in theory and in practice—should exercise its own instruments to address the irregularities.

Apart from the foregoing, for foreign insurance institutions from EU member states, performing insurance activity in Polish territory via a branch or in exercise of the freedom to provide services (i.e. passporting), a key provision is Art. 205(1) of the Insurance and Reinsurance Act, under which: “A foreign insurance institution from a member state of the European Union other than the Republic of Poland, conducting insurance activity in the territory of the Republic of Poland, shall apply the provisions of Polish law insofar as necessary for protection of the overriding public interest referred to in Art. 3(3) of the Act of 6 March 2018….”

In turn, the Act of 6 March 2018 states that the notion of an “overriding public interest” should be understood to mean “a value subject to protection, in particular public order, public safety, state security, public health, maintaining the financial stability of the social insurance system, protection of consumers, service recipients and employees, integrity in commercial transactions, combatting abuses, protection of the natural and urban environment, animal health, intellectual property, the goals of social and cultural policy, and protection of the national historical and artistic heritage.”

As explained in the public-law literature, “The overriding public interest is an indeterminate concept whose content is indicated by applicable law, the values pursued by the law, the political will, and a set of non-legal considerations. An important public interest is an interest that may potentially refer to many non-individualised addressees treated as a common entity. This is a multifunctional concept, internally complex and strongly conditioned externally. Thus any expectations for fixing the bounds of this concept are unrealistic. According to the case law from the Constitutional Tribunal, this is an indefinite concept whose function in the process of applying the law boils down to furnishing the possibility of decisively responding to factual situations of legal, social and economic importance which do not fall within the framework for assessment of typical individual factual states. In the provision in question, the parliament also uses another term, the ‘overriding public interest,’ and indicates its hallmarks. It appears that this is broader than the commonly used notion of an ‘important public interest’” (L. Bielecki, “Commentary on the Act on the Rules for Participation of Foreign Undertakings and Other Foreign Persons in Commerce in the Territory of Poland,” Art. 3, in P. Ruczkowski & L. Bielecki, Business Constitution: Commentary (Warsaw 2019) (ellipses omitted)).

Thus it may be seen that the scope of various provisions of Polish law which may refer directly or indirectly to values defined in the overriding public interest clause is unusually broad. Particular attention should be drawn to the protection of consumers and service recipients, as protecting these classes is undoubtedly the aim for which the regulator presented the draft Recommendations. Although the proposal uses the term “customer” (klient), and defines that term, nonetheless, with a view to the realities of insurance distribution and the Polish insurance market, this category will include:

- Consumers (B2C—insurance products in risk categories I and II under the annex to the Insurance and Reinsurance Act), as well as

- Corporate clients (service recipients, i.e. B2B—for example specialised products under risk category II).

It is key in this respect that the draft Recommendations are intended to broaden the scope of protection of customers of the insurance sector (among other things by eliminating the offering of insurance incompatible with the customer’s needs or of low value to customers)—and customers include both consumers and corporate clients.

Impact of the Recommendations on the insurance industry

Undoubtedly the publication of the draft Recommendations on insurance distribution will have a major impact on the operation of the entire insurance sector. Insurance institutions will have to take a number of measures to meet their new obligations.

Thus, bearing in mind that the aim of implementing the Recommendations is to broaden the scope of protection of customers of the insurance sector, it seems that foreign insurance institutions should also implement the KNF Recommendations into their structure and strategy for insurance distribution (obviously, once the final wording of the Recommendations is determined).

This applies to distribution of insurance through B2C channels (for example, “embedded insurance” for consumers) and through B2B channels (sale of corporate products, such as cyber policies or D&O coverage).

Mateusz Kosiorowski, adwokat, Agnieszka Kubowicz, attorney-at-law trainee, Insurance practice, Wardyński & Partners