New sustainability reporting

The proposed Corporate Sustainability Reporting Directive is now on the EU legislative agenda. It would amend the existing reporting rules established by the Non-Financial Reporting Directive, which are a weakness of the current system. Ultimately, the new directive is intended to contribute to a fully sustainable European market.

According to the proposal, the Corporate Sustainability Reporting Directive (CSRD) will amend four current EU legal acts:

- Accounting Directive (2013/34/EU)

- Transparency Directive (2004/109/EC)

- Statutory Audit Directive (2006/43/EC)

- Statutory Audit Regulation ((EU) 537/2014).

Thus the CSRD will modify the reporting rules established by the Non-Financial Reporting Directive (2014/95/EU—NFRD), while changing the terminology from “non-financial reporting” to “sustainability reporting.”

Genesis and purpose of the proposal

The European Commission committed to revising the NFRD in the European Green Deal and the 2020 work programme. The need to revise the existing reporting framework was also pointed out by the European Parliament in resolutions adopted in 2018 and 2020.

The overall purpose of the CSRD is to improve sustainability reporting. The directive is intended as a response to the shortcomings of the current system, which primarily include a lack of unified reporting standards and thus a lack of comparability between different entities’ data. The directive should increase the reliability, accessibility and detail of published sustainability information and expand the group of entities required to report, which is expected to meet the growing information needs of stakeholders.

Unification of reporting standards

The CSRD proposal stipulates that the Commission will develop European Sustainability Reporting Standards (ESRS). They will indicate how sustainability reports should be prepared. Currently, there are no common standards in place enabling a comparison of the sustainability information published by different entities. In the development of the ESRS, the Commission is to be assisted by the European Financial Reporting Advisory Group (EFRAG).

Expansion of the group of entities required to disclose sustainability information

Currently, the NFRD requires large public-interest entities with an average number of employees exceeding 500 during the fiscal year, as well as public-interest entities that are the parent of a large group with an average number of employees during the fiscal year on a consolidated basis also exceeding 500, to file non-financial reports.

The Accounting Directive recognises companies whose securities are admitted to trading on a regulated market of an EU member state, credit institutions, insurance companies, and other entities designated by member states, as public-interest entities.

The CSRD proposal expands the set of entities required to report, to include the following:

- All large entities, i.e. entities meeting at least two of the following three requirements as of the balance-sheet date:

- Balance-sheet total of more than EUR 20 million

- Net sales revenues of more than EUR 40 million

- Average number of employees in the fiscal year above 250

- Small and medium-sized companies listed on a regulated market of a member state, other than micro companies

- Non-EU entities that generate more than EUR 150 million in net sales revenue in the EU and have at least one branch or subsidiary in the EU.

Attestation of sustainability reporting

The CSRD proposal foresees that sustainability reporting will require attestation by a chartered accountant or independent accredited certifier. As a result, reports will be checked for, among other things, their compliance with the ESRS.

Consolidation of the rules for publishing reporting on sustainable development

The CSRD proposal indicates that information on sustainability reporting is to be included in the entity’s management reports. Currently, the rules allow this information to be published either as part of the management report or as a separate report on non-financial information. The proposal also stipulates that activity reports are to be published in the XHTML format.

Status of works

The CSRD proposal was presented by the European Commission in April 2021. At the end of June 2022, the Council and the European Parliament reached a preliminary agreement on the directive. The draft is currently awaiting further work.

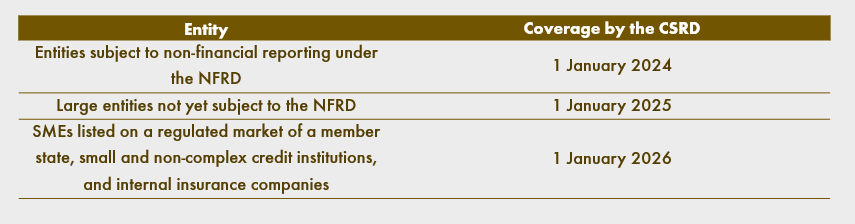

According to the current wording of the proposal, entry into force of the directive is spread over time for different types of entities.

Additionally, SMEs required to report after the provisions take effect will be able to opt out of sustainability reporting requirements for another two years, if they explain why they did not include sustainability information in their activity report.

Assessment of the proposal

The CSRD proposal forms part of the trend of EU legislation promoting ESG (environmental, social and governance) issues. Other legal acts of this type include for example:

- Sustainable Finance Disclosure Regulation ((EU) 2019/2088)

- Taxonomy Regulation ((EU) 2020/852)

- Pending proposal for a Directive on corporate sustainability due diligence (CSDD).

The CSRD is intended to counteract the weaknesses in the current sustainability reporting framework, such as the lack of uniform standards and a uniform reporting form, and the relatively narrow set of entities required to publish non-financial reports. According to estimates, the CSRD is expected to cover about 49,000 entities, while the NFRD imposes reporting obligations on about 11,000 entities.

Other advantages of the CSRD proposal include the introduction of an attestation requirement for reporting and the staggered entry into force of the directive for various entities, including allowing the SMEs covered by the directive a two-year opt-out from the reporting requirement, which is expected to allow these entities to gradually adapt to the new regulations.

Julia Dolna, M&A and Corporate practice, Wardyński & Partners